A Foot in the Door to the Alternative Protein Market

Developing a pea and fava bean protein market in New Zealand would have high environmental gains, finds new research – but who pays for the processing plant and how to grow value for growers are questions yet to be answered.

The alternative protein market is worth over $15 billion globally and is expected to increase to around $23 billion by 2026 – and there is plenty of scope for New Zealand’s arable growers to be involved, says Ivan Lawrie, general manager at the Foundation for Arable Research.

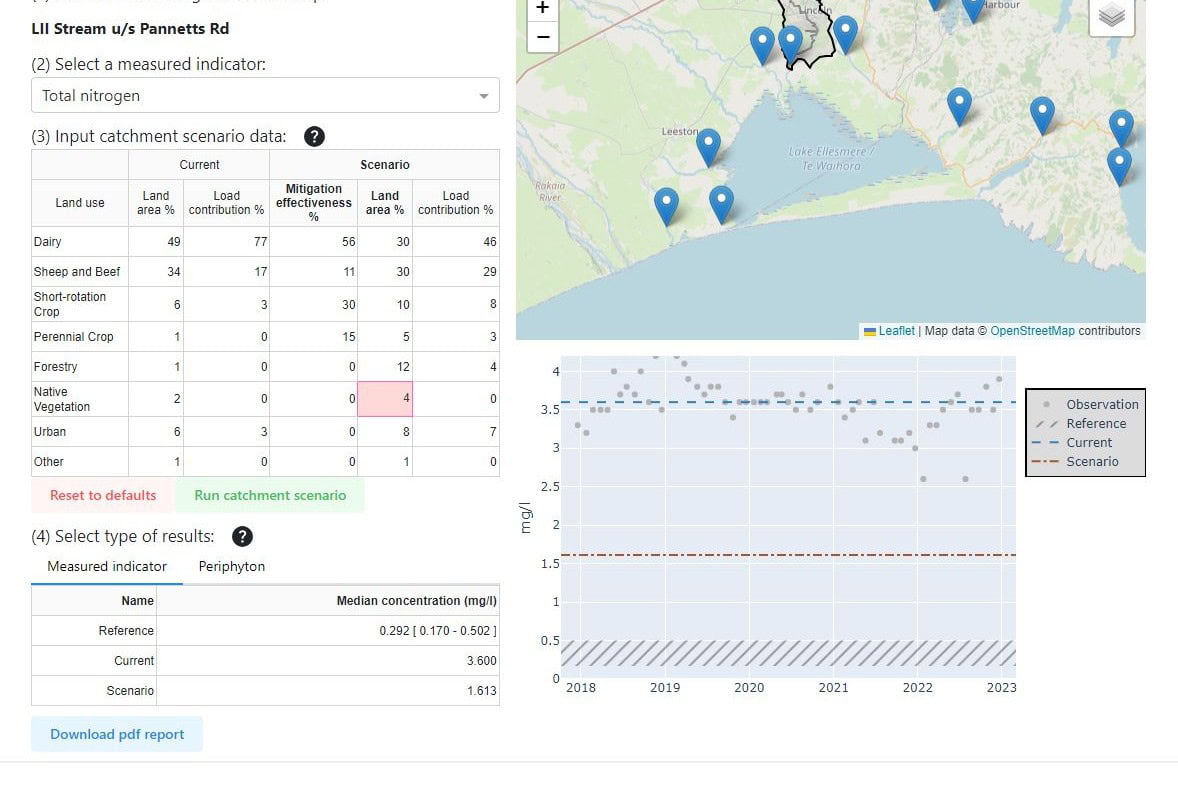

A new agricultural model developed for the New Zealand arable farming sector has been able to shine a light on the potential to increase our pea and fava bean production, with funding from the Our Land and Water National Science Challenge.

Developing a pea and fava bean protein market in New Zealand was found to have high environmental gains, with peas and beans requiring half the amount of irrigation water and five times less nitrogen to grow than other mainstream crops. If grown on land previously in pasture, three times less nitrogen fertiliser is required than the current 190kg/ha cap.

But environmental benefits alone are unlikely to sway growers, says Lawrie. Peas are not currently a high-value crop and that will need to change somewhat for growers to include it in their cropping options.

“If all business plans have been done on rock bottom commodity price it’s not going to work – you’re not going to get anyone to grow them.”

Everything hinges on increasing the value of the crop for growers, Lawrie says.

New Zealand food manufacturers are already importing both pea and fava bean protein. They will have to step up to the mark, placing greater value on locally grown protein, says Lawrie.

Processing capacity depends on crop area

Another challenge is the current lack of a protein processing plant in the country.

Building the necessary plant will likely cost around $50 million, but here ‘the chicken or the egg’ scenario kicks in: crop area will have to increase substantially to make the build worthwhile.

Pea production currently uses 7,000 hectares of land, produces around 4,900 tonnes of protein, and is worth about $29.5 million to the New Zealand economy.

A new extraction facility would be capable of processing around 15,000 tonnes of peas annually, which is the yield from 4,300 hectares of peas (although it could also extract protein from a range of vegetable products, possibly including pasture).

According to research by FAR, increases in crop value, land area and yield are also feasible in the near future. According to FAR’s short-term feasibility parameters (yields up from 3.5 to 5 t/ha yield; value rising from $960/t to $120/t; and land area increasing to 25,000ha) an additional $375 million could be gained, found the modelling.

Reasonable returns on investment will be needed for the processing plant, and this lends itself to growers getting involved, along with food processors, says Lawrie.

He is backed up by a study undertaken by Price Waterhouse Cooper last year for plant-based meat company Off–Piste Provisions, looking into the feasibility of increasing pea and fava bean production in New Zealand.

It found that for arable farmers in New Zealand to get a foot in the door of the alternative protein market, some serious co-operation between growers, processors and food manufactures will be needed, not to mention a premium for the final products.

How do we know this?

Being able to see the flow-on effects when something in the system changes makes it easier to make decisions and plan to become more resilient to climate change and major disruptions, and to produce food more sustainably while maintaining good returns.

Scientists at University of Canterbury and Manaaki Whenua Landcare Research developed a model specifically aimed at New Zealand’s agricultural systems and conditions, with data from NZ’s Arable Food Industry Council, StatsNZ, and the Food and Agriculture Organisation of the United Nations. It is one of just a few agricultural models anywhere in the world that have been designed to combine production methods, emissions, energy, land use, water use, fertiliser use and profitability.

Aimed at national and regional policymakers, and agricultural industry leaders, the model has used real-world questions and scenarios, says modelling scientist Dr Clémence Vannier of Manaaki Whenua Landcare Research. As well as looking at alternative protein production, the researchers modelled two further scenarios for arable agriculture in New Zealand: on becoming self-sufficient in milling wheat and another to mitigate climate change.

This article was first published by Farmer's Weekly and is republished by agreement.

More information:

- Link to the new agricultural model developed for the New Zealand arable farming sector

- Future Scenarios for Arable Agriculture project

- Scenario 1: Self-sufficiency for wheat

- Scenario 2: Mitigate climate change

- Scenario 3: Alternative protein production (above)

Author

View Our Strategy Document 2019 – 2024

View Our Strategy Document 2019 – 2024

Leave a Reply